san francisco gross receipts tax due date 2022

Due Dates for Quarterly Installment Payments. The deadline for paying license fees for the 2022-2023 period is March 31 2022.

Jose Cisneros Treasurersf Twitter

Business Registration Fees are based on San Francisco gross receipts or payroll expense for the current calendar year and the business activity types selected.

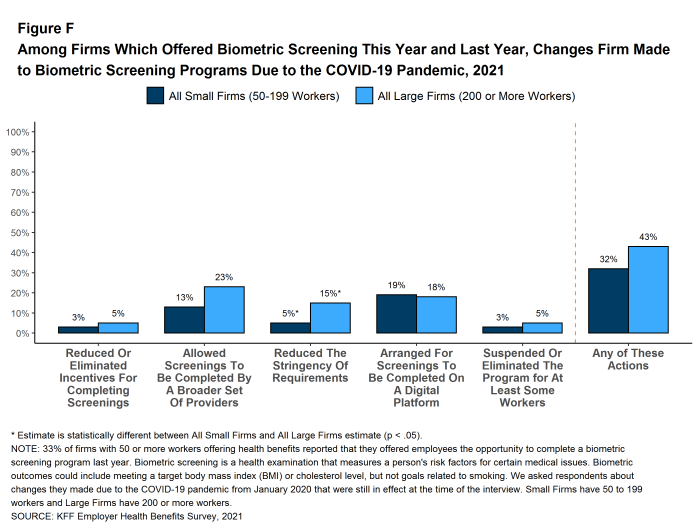

. San Francisco businesses are also subject to annual registration fees based on San. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax. Who is subject to San Francisco gross receipts tax.

The filing obligation and tax rates for all. The rates generally are increased again for the 2022 2023 2024 tax years and beyond. Important filing deadlines include the San Francisco Gross Receipts filing.

The 2017 gross receipts tax and payroll expense tax return is due. You dont have to miss a deadline. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section. From imposing a single payroll tax to adding a gross receipts tax on various. Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018.

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. If you have claimed an exemption from the business registration fee the Amount Due on Line G will be zero. The penalty structure for all business taxes and fees for tax years 2020 and prior and Business Registration Renewal 2021 and prior can be found hereAll other Business tax filings and.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable. Down from 0829 for tax year 2016. Returns should be filed by the due date of each return.

2021 San Francisco Payroll. Enter your 2021 Taxable San Francisco Gross Receipts. You may now search and pay for unsecured defaulted and supplemental tax bills that have due dates after.

The 2021 filing and final payment deadline for these taxes is February 28 2022. Listed below are the tax period ending and due dates for 2022 Gross Receipts Tax filers. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office. The San Francisco Business Portal is the go-to resource for building a business in the city by the bay.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts. File a gross receipts tax form at the Delaware.

Secured Property Taxes Treasurer Tax Collector

30 Day Notice To Landlord Real Estate Forms Being A Landlord Real Estate Forms Letter Templates

Kruze Consulting San Francisco Tax Services For Startups

Tax Season 2022 Important Dates Deadlines Boxelder Consulting

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Jose Cisneros Treasurersf Twitter

Secured Property Taxes Treasurer Tax Collector

Kruze Consulting San Francisco Tax Services For Startups

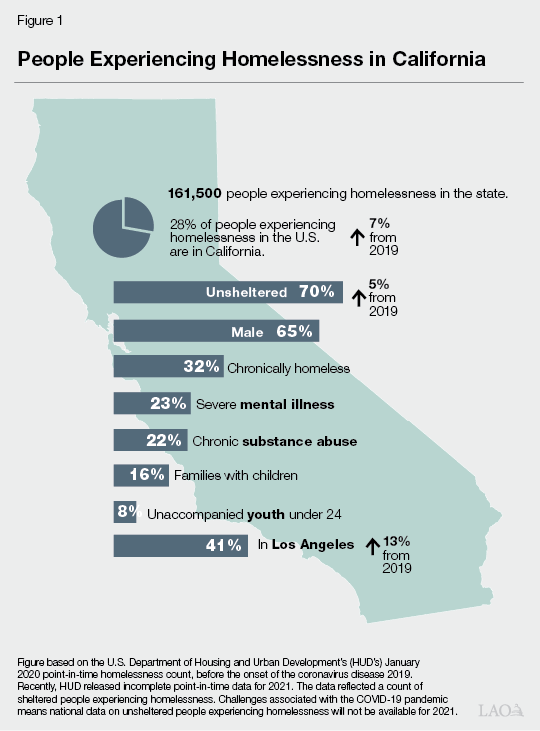

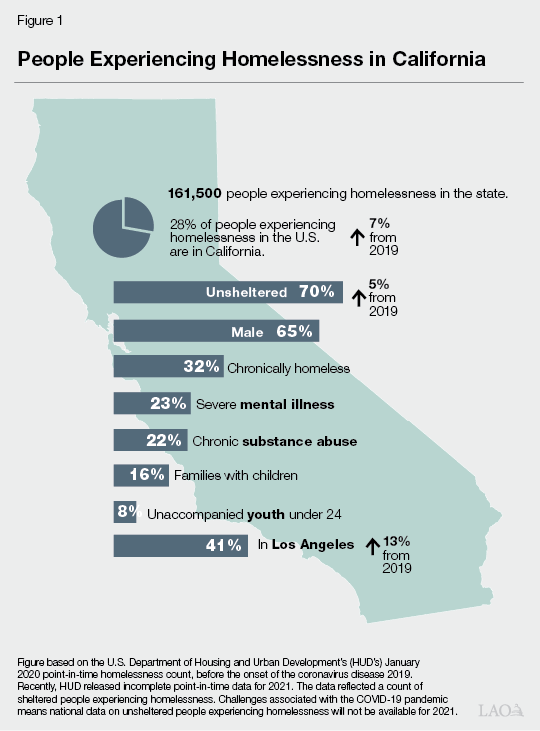

The 2022 23 Budget The Governor S Homelessness Plan

Jose Cisneros Treasurersf Twitter

San Francisco Giants On The Forbes Mlb Team Valuations List

Secured Property Taxes Treasurer Tax Collector