child care tax credit calculator

This goes up to 1000 every 3 months if a child. Do not include the cost of schooling for a child in kindergarten or above overnight camps summer school or tutoring programs.

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Big changes were made to the child tax credit for the 2021 tax year.

. The two most significant changes impact the credit amount and. The maximum amount of qualified. Ad File a free federal return now to claim your child tax credit.

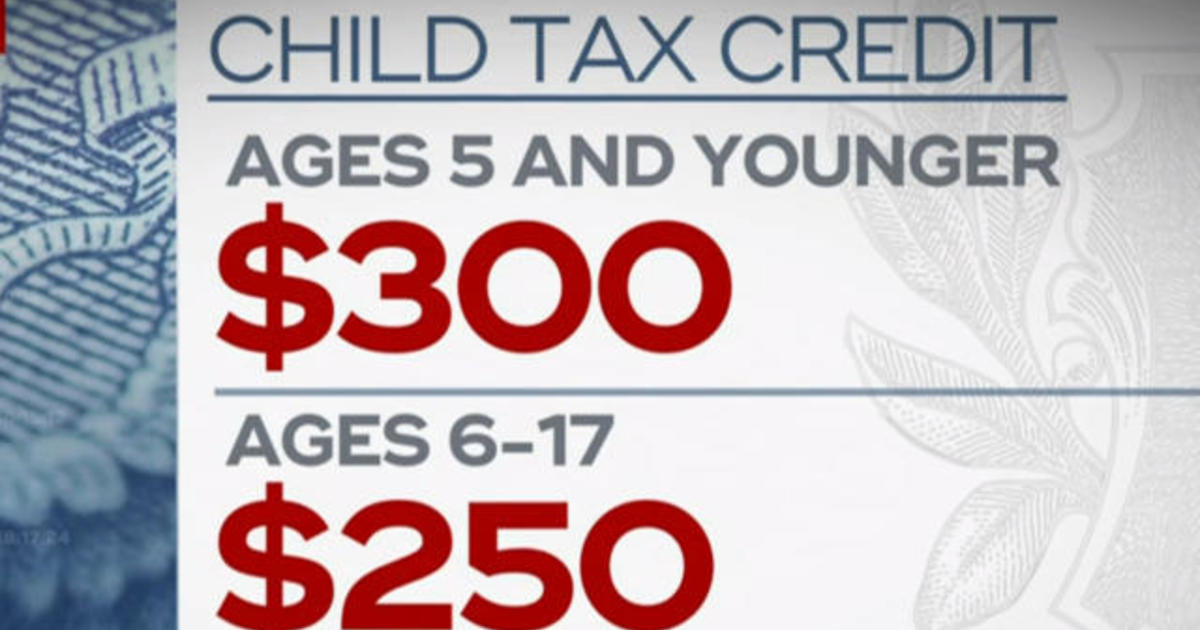

The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. Help with childcare costs if your child is under. For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses.

The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going. You can use this calculator to see what child. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Child and family benefits calculator. The 2021 Child Tax Credit. Use these Calculator Tools for the current tax yearPrepare and e-File the.

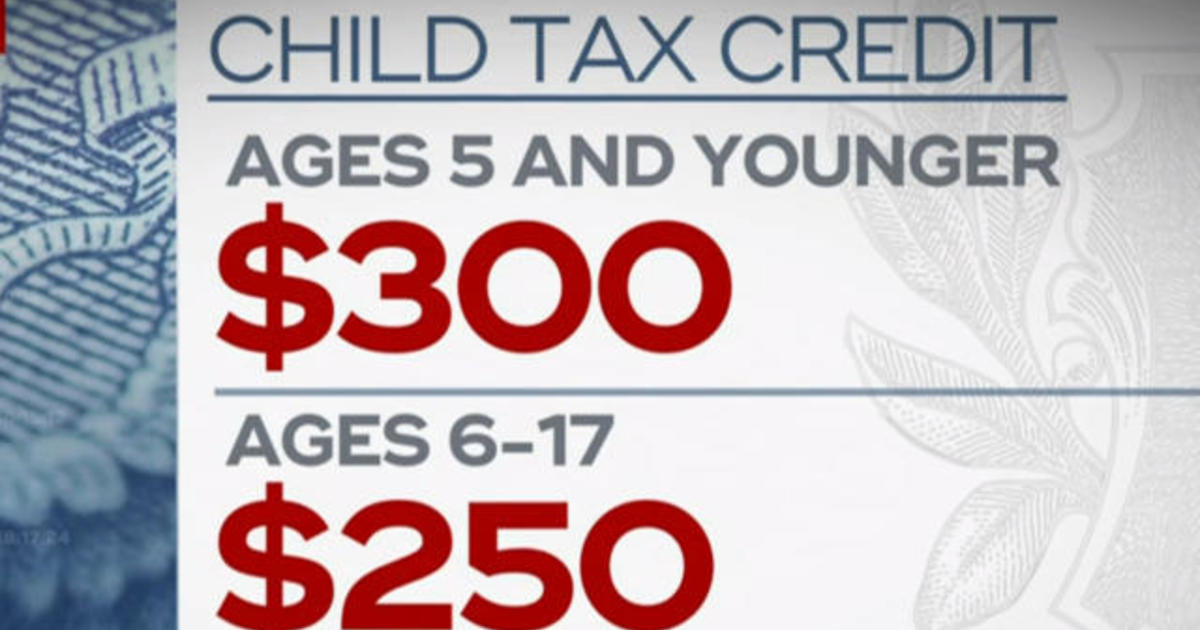

For the 2020 tax year the child. Child Tax Credit Calculator for 2021 2022. Your amount changes based on the age of your children.

Approximate value of fully utilizing the. Up to 3600 per qualifying dependent child under 6 on Dec. Use this calculator to find out how much you could get towards approved childcare including.

51 minus 2 percentage points for each 3600 or part of above 60000. You can no longer eFile 2020 Tax Returns. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. For the 2021 tax year the child tax credit offers. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

For example if your income is 10000 your Ontario Child Care Tax Credit rate. The child tax credit is a credit that can reduce your Federal tax bill by up to 3600 for every qualifying child. If you get Tax-Free Childcare the government will pay 2 for every 8 you.

Ages five and younger is up to 3600 in total up to. The new system is part of the American Rescue Plan which increased the total credit from 2000 per child in 2020 to 3600 per child under age 6 and 3000 per child ages. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child.

Free childcare for children aged between 2 and 4. You can get up to 500 every 3 months up to 2000 a year for each of your children to help with the costs of childcare. You can get up to 500 every 3 months 2000 a year for each of your children to help with the costs of childcare.

Child Care Tax Credit Calculator. Our calculator will give you the answer. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses.

Home Share via Facebook Share via Twitter Share via YouTube Share via Instagram Share via LinkedIn. The payment for children. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

As you answer simple questions the tax software knows exactly how much youre. The California Child Support Guideline Calculator is based on the same child support legal guidelines used in California courts and can be used to estimate the amount of child support. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Complete IRS Tax Forms Online or Print Government Tax Documents. The child tax credit. The Child and Dependent Care Tax Credit helps working families cover the high costs of child or dependent care so that parents are able to look for work and stay employed.

The tool on this page is only for tax year 2020 not the current tax year. Estimate your 2021 Child Tax Credit Monthly Payment. Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or.

To be a qualifying child for. The percentage depends on your adjusted gross income AGI. Up to 3000 per qualifying dependent child 17 or younger on Dec.

The payments for the CCB young child supplement are not reflected in this calculation. Your Adjusted Gross Income AGI determines how much you can. How much is the child tax credit worth.

The credit will be fully. Online tax software offers an easier way to fill out the proper forms to calculate and claim child tax credits. The new advance Child Tax Credit is based on your previously filed tax return.

2021 Health Insurance Marketplace Calculator Kff

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit Do You Have To Pay It Back In 2022 Not If You Re In These Cases Marca

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

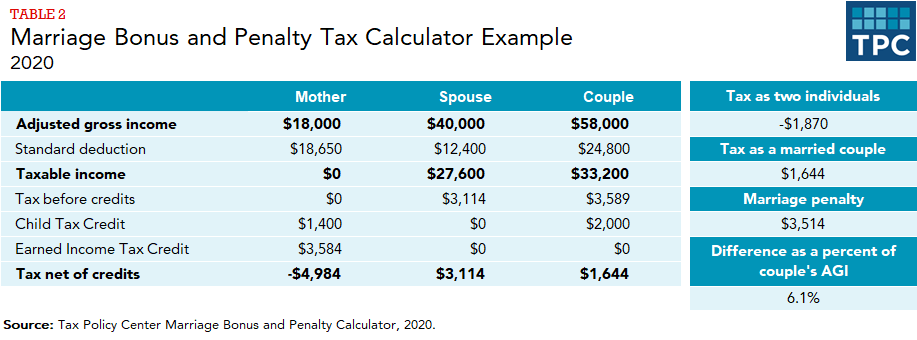

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Tax Credit Definition How To Claim It

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

What Are Marriage Penalties And Bonuses Tax Policy Center

September Child Tax Credit Payment How Much Should Your Family Get Cnet

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Calculating The Hidden Cost Of Interrupting A Career For Child Care Center For American Progress

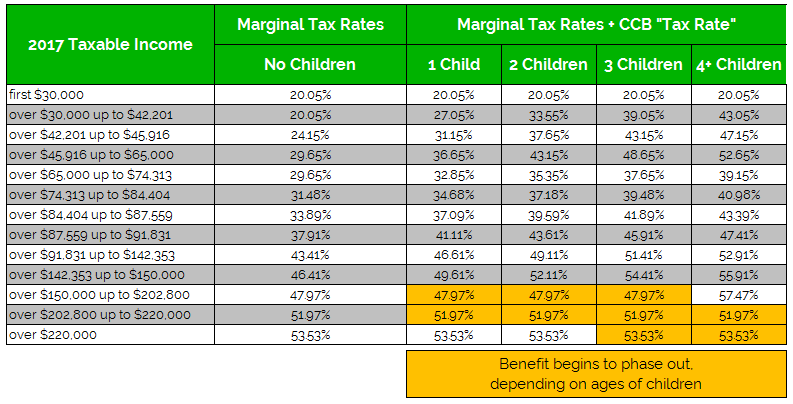

Canada Child Benefit The Hidden Tax Rate Planeasy

September Child Tax Credit Payment How Much Should Your Family Get Cnet

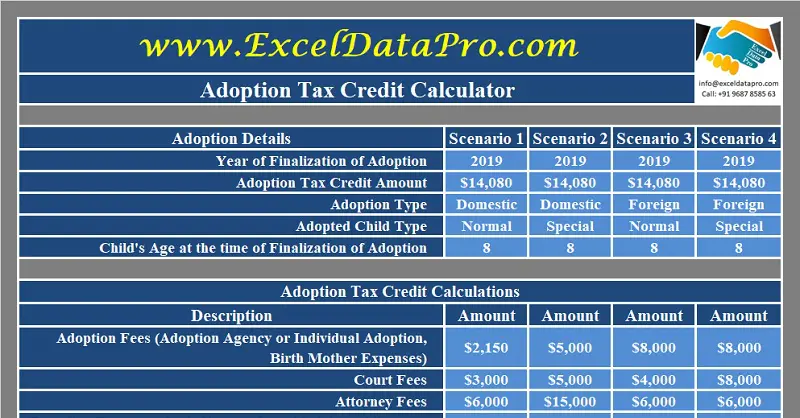

Download Itemized Deductions Calculator Excel Template Exceldatapro

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News